So, first off, some basic facts:

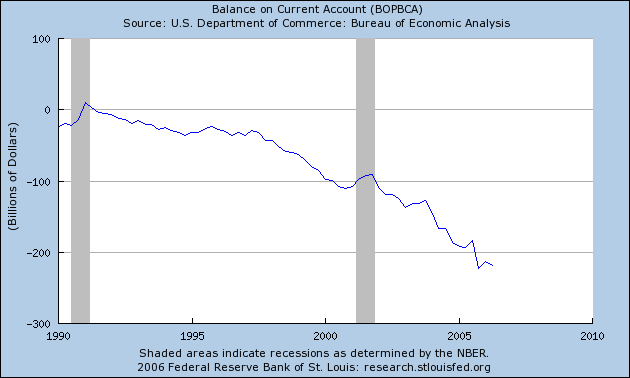

(1) Foreign individuals, institutions, and governments own a huge and rapidly growing quantity of US assets. This is dramatically shown in a graph of the US current account balance showing how many more goods and services* people in the US buy from foreigners than they sell to them. This goods and services deficit is covered by purchases of US Treasury Securities and other US investments by foreigners.

(3) The countries with the largest positive balances are China, Japan, Russia, Saudi Arabia, and (a bit of a surprise) Germany. Though large, the combined surpluses of China, Japan, Russia, and Saudi Arabia are only equal to 65% of the US deficit. The other countries with large positive balances are for the most part oil producers, like Saudi Arabia, or industrial nations in Europe, like Germany.

(4) There's a risk that individuals, institutions, and central bankers in countries with large postive balances will disrupt the US economy by deciding not to fund the US negative balance. This risk is said to be negligible because the disaster that would result would greatly injure the economies of those countries.

That said, there's a new set of fears:

Although individuals and institutions in the countries with the largest positive balances have bought a whole variety of US assets -- stocks, bonds, and real estate as well as Treasury Securities, the central banks of these countries have tended to use their surplus cash to make extremely conservative investments, mostly purchases of US Treasury Securities. This situation is rapidly changing as the central banks are setting up Sovereign Wealth Funds which they use to invest in stocks, bonds, and real estate. This graph gives some idea of the size of SWFs.

The first fear is that the SWFs will increasingly put their investments outside the US. This fear stems from the slow down in the US economy, particularly in contrast to other advanced industrial economies. On the whole, the US slow down is good news since it means the economy is gradually retreating from overheating (as represented by the melt-down in housing). The fear arises as the US economy is seen to lag and investments elsewhere become more attractive. This lag can be seen in this graph showing the gap between the gross domestic product of the US compared with the rest of the world.

The second fear is that a country such as China or Russia could use its SWF to interfere in the internal affairs of the US. Think of the way the US likes to put pressure on Japan to prevent Japanese automakers from destroying the US auto industry.

A recent blog entry on the Financial Times web site points discusses the growth of SWFs and points to some of the potential outfall of this growth: Sovereign wealth funds and the $2,500bn question

Extracts:

Sovereign wealth funds are rapidly becoming a huge force in global markets and economies, as the world is seeing in China's move to kick off its own SWF with a $3bn investment in the IPO of private equity group Blackstone. But equally compelling issues lie ahead in the nature and operation of these often opaque investment vehicles, says the FT.A column in the Washinton Post gives a more acute presentation of risks:

Driven by trade surpluses unequalled as a percentage of the global economy since the beginning of the 20th century, official reserves held by some governments are now astronomically high, amid mounting pressure to earn better returns by putting the money with specialised investment agencies.

How and where this massive – and often secretively managed – pool of funds is deployed will be one of the big investment themes of coming years.

The IMF warned recently of the risks arising from the fact that public sector institutions such as SWFs are now large players in world financial markets.

The Next Globalization Backlash

Wait Till the Kremlin Starts Buying Our Stocks

By Sebastian Mallaby

Mallaby says SWFs are large and growing. Financial reserves held by central banks has more than trebbled over the past five years. This money is finding its way into SWFs. To take one example, the SWF of the United Arab Emirates is estimated at a trillion dollars. SWFs are virtually inevitable. The countries that set them up first, years ago, have profited greatly. A recent book** declares that governments would be irresponsible if they did not set them up.

Here's his statement of the fear:

Chunks of corporate America could be bought by Beijing's government -- or, for that matter, by the Kremlin. Given the Chinese and Russian tendency to treat corporations as tools of government policy, you don't have to be paranoid to ask whether these would be purely commercial holdings.======

But the final straw may be that even the least threatening form of investment -- the purchase of publicly traded equities -- will not escape controversy. This is because of that second upheaval: the advent in the United States of something approaching shareholder democracy. As Alan Murray writes in his new book, " Revolt in the Boardroom," companies are no longer controlled by all-powerful CEOs. Instead, chief executives increasingly live in fear of activist shareholders and directors. Bosses from Harry Stonecipher of Boeing to Carly Fiorina of Hewlett-Packard have been ejected from the corporate suite in a manner that would not have been conceivable a generation earlier.

What if the Chinese are seen to have a hand in the firing of some future Fiorina? The more shareholders exercise power, the surer the backlash against governments that buy up chunks of the stock market.

Notes

*Actually not just goods and services, but also income from US investments abroad and net unilateral current transfers (such as foreign aid).

**This book is forthcoming from a UK publisher: Sovereign Wealth Management; see the chapter by Larry Summers, former US Secretary of the Treasury, Opportunities in an era of large and growing official wealth.

No comments:

Post a Comment